Your Dreams Matter

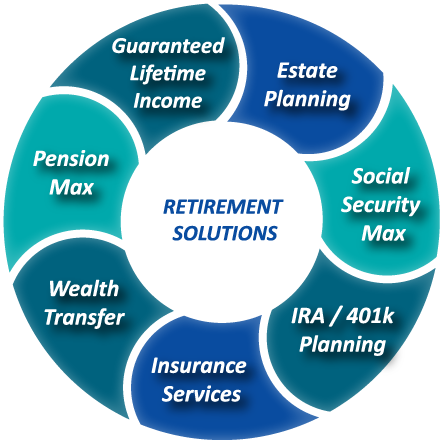

At Union Retirement Solutions, we believe everyone should be able to live the retirement they’ve always wanted. Our team of professionals can help you create a well-thought-out strategy, using a variety of insurance products and services, to help you address your financial needs and concerns.

Our Comprehensive Approach

When you and your family partner with Union Retirement Solutions, you receive a personalized plan that extends beyond the simple allocation of assets. We focus on the connection of the individual components as part of a greater overall plan in order to maximize every stage of your retirement. From wealth accumulation to wealth transfer with estate planning, our goal is to provide you with retirement security.

We offer services in these three areas:

Grow

Prepare for retirement by putting your hard-earned assets to work.

How?

Retirement Income Strategies

Annuities

Investments

IRA & 401(k) Rollovers

Preserve

Protect the assets that can help you live the retirement you’ve always imagined.

How?

Asset Protection Strategies

Life Insurance

Tax-Efficient Strategies

Long-Term Care Strategies

Give

Provide for the people and causes you care about the most.

How?

Legacy Planning

Estate Planning

Trusts

We can also refer you to professionals who provide the following services:

Probate

Charitable Giving

Tax Planning

We prepare Revocable Living Trusts, Wills, H.I.P.A.A.-compliant Power of Attorney for Asset Management, Advanced Directives for Health Care, Mental Health Directives and Living Wills.

INSTANT DOWNLOAD

Your Taxes and You

Would you like to avoid surprises at tax time?

Tax laws change every year — and this year is no different! This downloadable guide will walk you through the latest tax law changes to help you avoid any surprises. In this 12-page guide, you will find out:

- What the Tax Cuts and Jobs Act could mean for you

- How inflation could affect your tax bill

- Why proactive planning can help give you financial confidence

- How your financial professional can coordinate with a tax professional to help you create a tax-efficient strategy

Ready to take

The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a workshop or webinar.